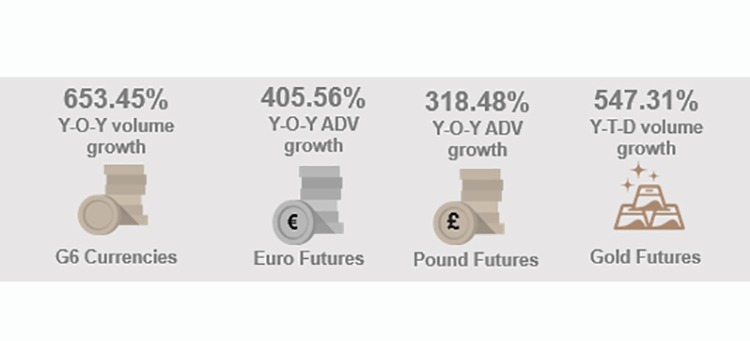

The Dubai Gold and Commodities Exchange (DGCX) continued to see robust trading activity in April. Members were busy protecting themselves against volatility and global economic uncertainty. The currency volatility continued and there were varying views on the dollar as a safe haven. The DGCX last month, most notably recorded a surge in trading of its G6 currency portfolio. It registered a year-on-year (Y-O-Y) volume growth of 653.45%.

Among the G6 Currency pairs, Euro and British Pound Futures contracts were the most prominent. It recorded an impressive Y-O-Y ADV growth of 405.56% and 318.48% respectively.

Meanwhile, DGCX’s Gold Futures product continues to perform strongly. It recorded a year-to-date (Y-T-D) volume growth of 547.31% compared to the same period last year.

Les Male, CEO of DGCX, said: “April was another extraordinarily busy and volatile month for global markets. Oil prices plummeted amid forecasts that demand will plunge this year, gold prices surpassed the $1,700 threshold once again, while the US dollar steadied or weakened against most major currencies, having previously strengthened in the first quarter of this year. During these periods of uncertainty, markets such as the DGCX support the resilience of the global and regional economy by allowing investors and businesses to protect their positions against price fluctuations. What we are seeing is truly unprecedented, and it has never been more important for our tools and services to be available, and for markets to remain open and transparent to give investors confidence.”

Total volumes on the DGCX in April totaled 810,000 million contracts, valued at USD 20.02 billion. The Exchange last month also recorded Average Open Interest (AOI) of 246,080 contracts, bringing the AOI for 2020 to 347,955 contracts, up 20.42% from last year.

“The DGCX continues to operate normally across both the exchange and clearinghouse, and we remain committed to providing the vitally important functions of risk management and price discovery in today’s challenging environment,” Male further added.