Gold – An ultimate investment for tough times

Gold complement stocks, bonds, and alternative assets for well-balanced US investor portfolios. It has not only outperformed many major asset classes but also provided robust performance in both rising and falling markets. Gold enhances the portfolio in four ways including generating long-term returns, acting as an effective diversifier, and mitigating losses in times of market stress as well. The cherished yellow metal provide liquidity with no credit risk while improving overall portfolio performance.

Ways of investing in gold

While investing in gold, always research or take expert help to understand the best product that suits one’s needs. Most widely accessible options include physical gold, gold-backed ETFs, allocated gold accounts, internet investment gold, and gold mining stocks.

The relevance of gold in the current environment

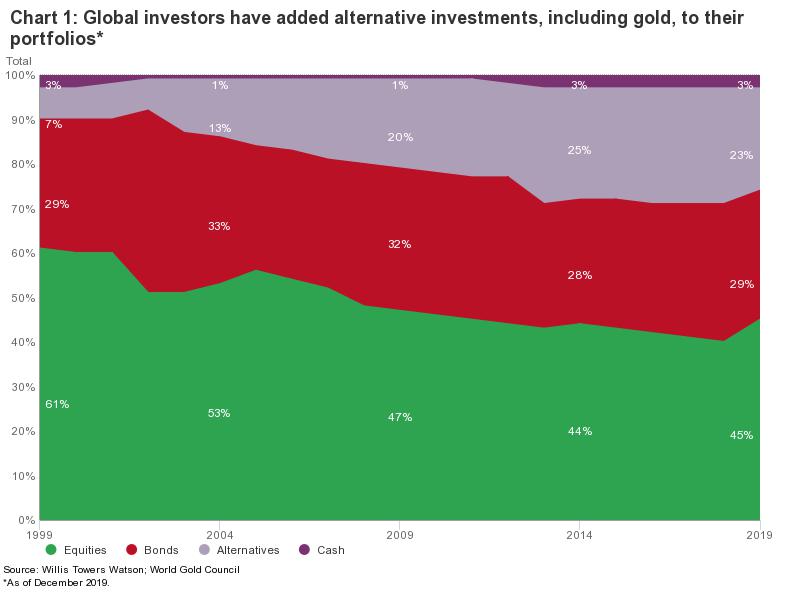

Gold turned out to be increasingly relevant in the current environment. Investors are embracing alternatives to traditional stock and bond investments for diversification and higher risk-adjusted returns. The factors responsible for the growing importance of gold as a mainstream investment include various factors such as emerging market growth, monetary policy, and central bank demand. Investors are embracing alternatives to traditional stock and bond investments in pursuit of diversification and higher risk-adjusted returns.

The strategic role of gold

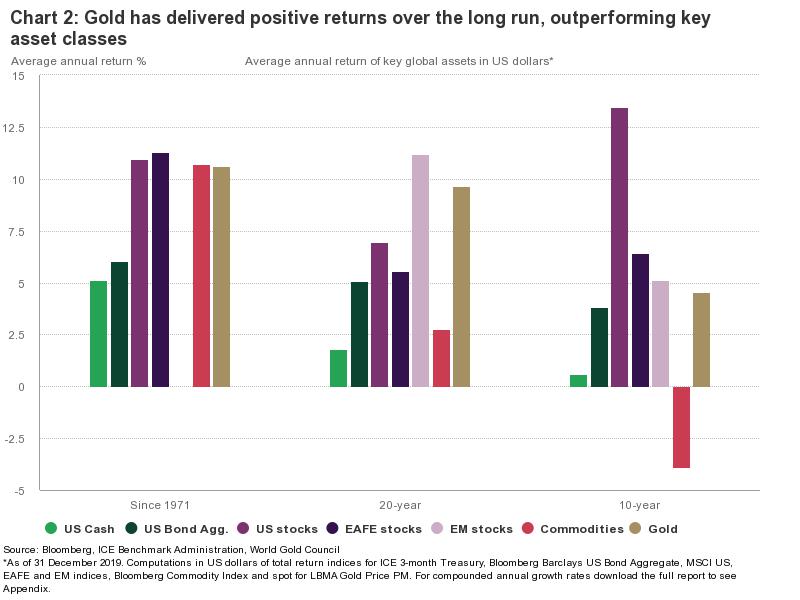

Gold is complementing stocks, bonds, and broad-based portfolios. In addition, gold is considered as the store of health and a hedge against systemic risk, currency depreciation, and inflation. Gold, a beneficial asset proved to generate long-term positive returns in both good and bad times. Since 1971, the price of gold has increased by an average of 10 % per year. Over the past two decades, the yellow metal outperformed other major assets.

Gold valuation

Gold value does not conform to the usual valuation frameworks used for stocks or bonds. According to the research, gold’s value is intuitive. The performance of gold is based on four sets of drivers. The four main drivers include economic expansion, risk and uncertainty, opportunity cost, and momentum.

Gold- guard against inflation

Moreover, gold is considered a hedge against inflation. The average annual return of 10 %, over the past 49 years outpaced the US consumer price index. Gold also protects investors from extreme inflation. The Oxford Economics research shows that gold should do well in periods of deflation, characterized by low-interest rates, reduced consumption, and investment and financial stress.

Gold outperformed all major fiat currencies

Gold significantly outperformed all major currencies as means of exchange since 1971 with the collapse of Bretton Woods. The outperformance was noticed after the end of the Gold Standard and the subsequent default of major economies that have changed over time. The key reason behind its outperformance was due to supply growth by contrast fiat money can be printed in unlimited quantities to support monetary policy.

Diversification matters

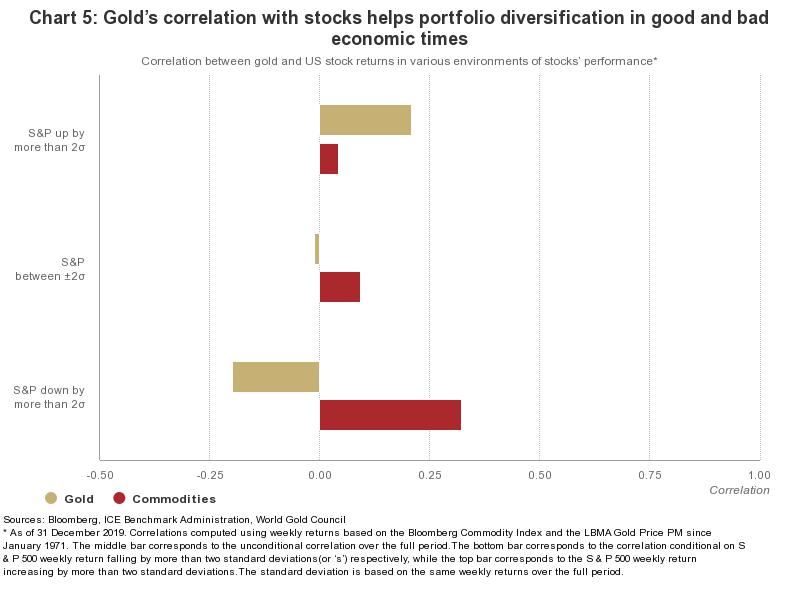

Many so-called diversifiers failed to protect portfolios when investors needed the most but gold is different. It remained constant even from December 2007 to February 2009, when the S& P fell by 50%. During crises, gold allows investors to meet liabilities when liquid assets are difficult to sell, undervalued, or mispriced. Gold not only allows investors during a time of crises but also deliver positive correlation with stocks and other risk assets in positive markets.

Gold’s liquidity

Gold’s liquidity

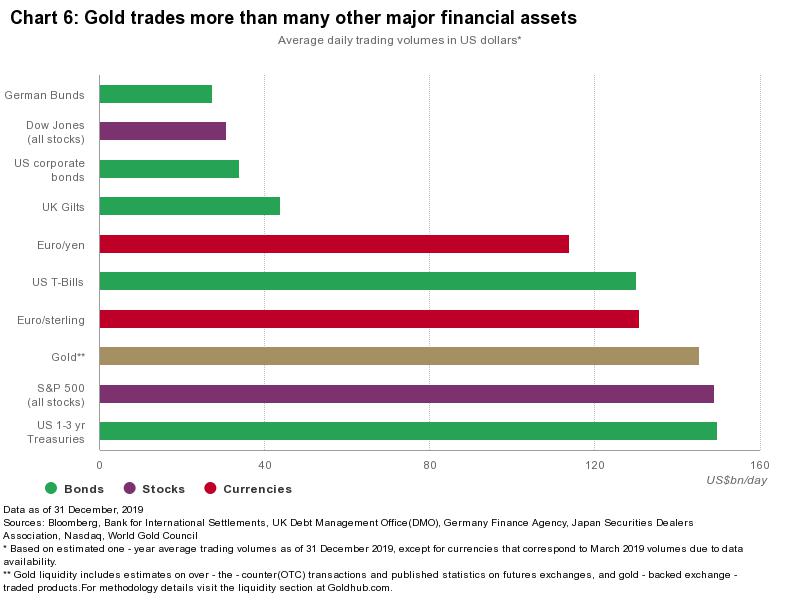

The gold market is considered more liquid than several major financial markets including German Bunds, euro/ yen an the Dow Jones Industrial Average. The trading volumes are similar to the S& P 500. In 2019, the trading volume of the gold averaged the US $ 145bn per day. Gold futures traded US$ 65 bn per day across various global exchanges around this time. Over-the-counter spot and derivatives contracts accounted for US $ 78 bn. Gold-backed ETFs offer an additional source of liquidity with the largest US-listed funds trading an average of US $ bn per day.

Enhanced portfolio performance

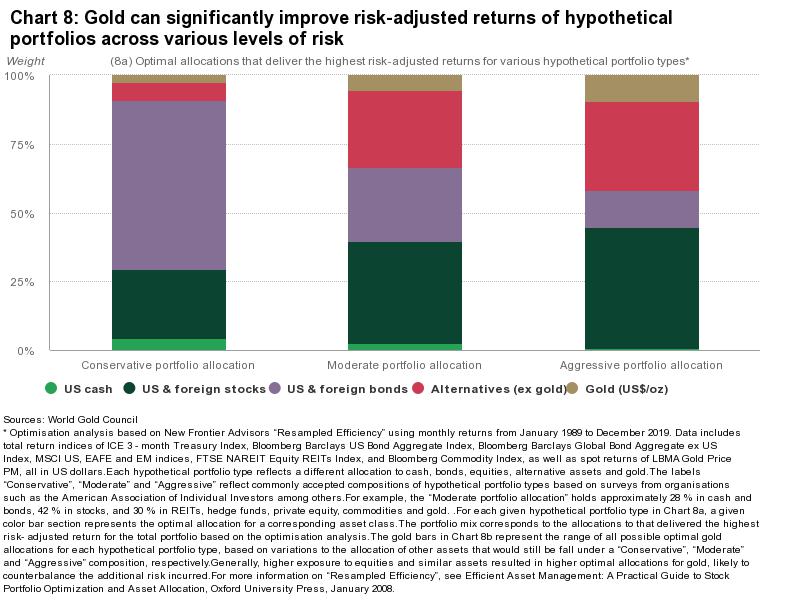

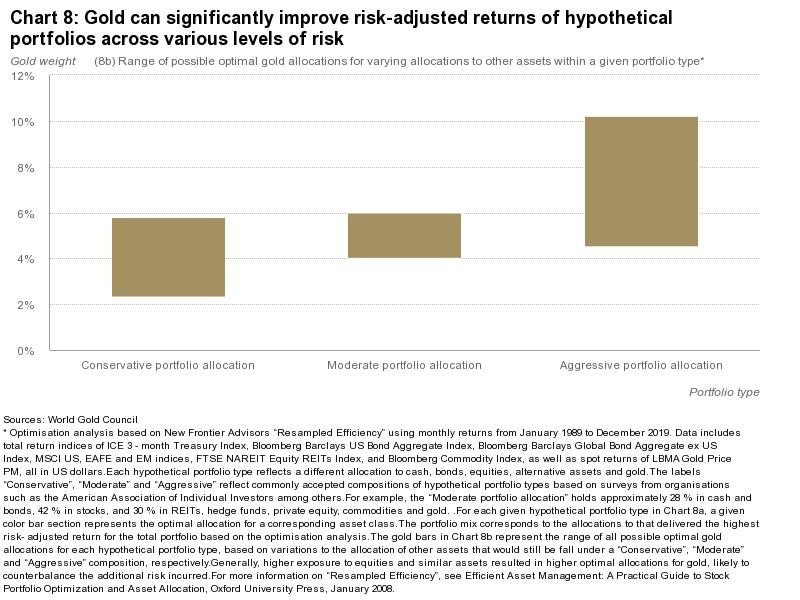

Overall portfolio performance depends on long-term returns, liquidity, and effective diversification. According to the analysis by the New Frontier Advisors Resampled Efficiency, US dollar-based investors can benefit from a material enhancement in performance if they allocate between 2% and 10% of a well-diversified portfolio to gold.

The amount of gold varies according to individual asset allocation decisions. The higher the risk in the portfolio, the larger the required allocation to gold within the range in consideration, to offset that risk.

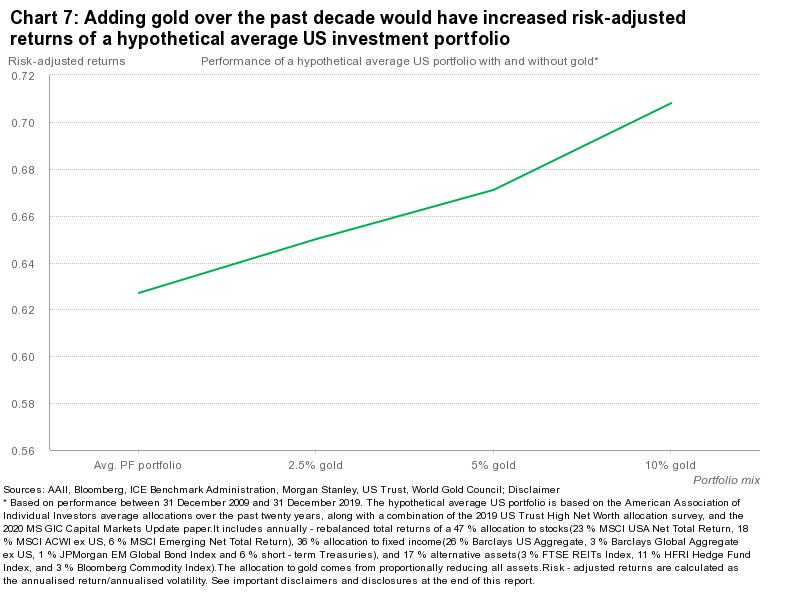

Performance of a hypothetical average US portfolio with and without gold

The hypothetical average US portfolio is based on the American Association of Individual Investors’ average allocations over the past twenty years. The study also includes a combination of the 2019 US Trust High Net Worth allocation survey. The 2020 MS GIC Capital Markets Update paper is incorporated. It also includes an allocation to stocks, allocation to fixed income, and alternative assets. The allocation to gold comes from proportionally reducing all assets.

What is setting gold apart from the commodity complex

Gold is a part of the commodity complex whether as a component of a commodity index, a security in an ETF, or future trading on a commodity exchange. Though gold has some similarities with commodities it has some differences too. Though gold is scarce but highly liquid. Gold supply limits uncertainty and volatility. Moreover, it does not degrade over time, unlike other commodities.