DMCC’s latest Future of Trade 2020 report providing recommendations to the Government and business to slowdown in global trade. The application of technology to trade, the growth of cross-border services, innovation in trade policy, and trade-related infrastructure development can act as the catalysts to boost trade. The report was launched during a webinar where attendees were briefed on the findings and key recommendations for government and business to enable trade in the 2020s and beyond. A series of conversations with international trade experts also looked at ways to practically enact the report’s key recommendations.

DMCC’s flagship thought leadership report – now in its third edition – examines the impact of geopolitics, technology, COVID-19, and global economic trends on the future of trade. In addition to offering analysis, the report provides clear and tangible trade policy recommendations to government and business.

According to the research, geopolitical tensions, namely the US-China trade war, and economic recovery from the global COVID-19 pandemic will define the trade landscape of the 2020s. While the pandemic has caused the fastest and deepest economic shock in history, it has already significantly shaped the future of trade by accelerating trends such as digitalization, the recalibration of global supply chains, and a reconsideration of the role of national security in trade policy.

Ahmed Bin Sulayem, Executive Chairman, and Chief Executive Officer, DMCC said

Ahmed Bin Sulayem, Executive Chairman, and Chief Executive Officer, DMCC said

“The Future of Trade report explores the various scenarios for the road ahead in what is an unprecedented time for global trade. Despite the evident economic uncertainty of the time, our research shows that one thing is certain – the future of trade, and indeed the future of the economic recovery, relies heavily on global cooperation. Finding common ground and collectively making the case for international trade will be key determining factors of success. With this research, DMCC set out to not only identify barriers to global trade but provide solutions to them.”

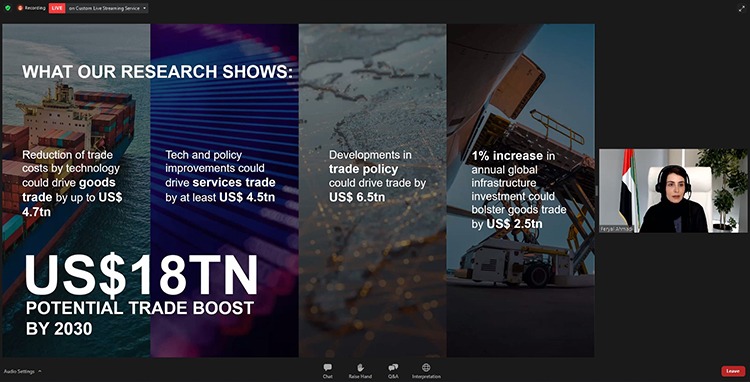

Feryal Ahmadi, Chief Operating Officer, DMCC said “In 2020, the global trade order is at a tipping point that will define the decade ahead. However, the Future of Trade report illustrates that if businesses and governments are willing to collaborate to overcome some of the barriers at hand, the outcome will be a positive one. Within our research, we have identified four key components that, if taken together, could drive trade by USD 18 trillion up to 2030. These include the implementation of technology that supports trade, the growth of cross-border services trade, innovation in trade policy, and the investment in trade related infrastructure”.

Feryal Ahmadi, Chief Operating Officer, DMCC said “In 2020, the global trade order is at a tipping point that will define the decade ahead. However, the Future of Trade report illustrates that if businesses and governments are willing to collaborate to overcome some of the barriers at hand, the outcome will be a positive one. Within our research, we have identified four key components that, if taken together, could drive trade by USD 18 trillion up to 2030. These include the implementation of technology that supports trade, the growth of cross-border services trade, innovation in trade policy, and the investment in trade related infrastructure”.

Key findings of the report

The politics of trade

- The strategic rivalry between the US and China will be the defining dynamic for international relations and global trade in the 2020s – with global trade tensions likely to get worse before they get better.

- The US-China trade tensions have given cover for other actors to implement protectionist agendas. Protectionist measures were at a historic high in 2019, a situation which has been exacerbated by the COVID-19 pandemic in 2020.

- WTO reform is highly unlikely in the current climate. In the interim, economies will need to become more innovative to create a new trade order reliant on plurilateral, regional, and bilateral agreements.

- Global trade tensions have driven a recalibration of supply chains that will see greater simplification and diversification. The COVID-19 pandemic will further drive this trend.

- In this environment, the strategic objective of supply chains becomes one of risk resilience, in addition to cost efficiency.

Technology and trade

- Technologies such as artificial intelligence, blockchain, and digital platforms have the potential to drive trade by increasing efficiency, driving down costs, and opening new business and trade opportunities.

- While some technologies have the potential to boost trade – others may disrupt current patterns of production and trade and reduce international trade; the net effect of technology on trade growth could be only USD 400 billion (AED 1.469 trillion).

- Automation and robotics will shorten supply chains by moving manufacturing closer to centres of consumption while additive manufacturing will undermine components supply chains.

- There is an urgent need for governments to address the fragmentation of the global technology policy environment, to prevent the evolution of separate standards, applications, and systems.

Making trade happen: finance and infrastructure

- There are significant gaps in terms of financing. There is a USD 1.5 trillion (AED 5.5 trillion) gap in trade finance, which is predicted to widen to USD 2.5 trillion (AED 9.18 trillion) by 2025.

- Similarly, there is a USD 6 trillion (AED 22 trillion) gap between infrastructure needs and the available financing. This gap is predicted to widen to up to USD 15 trillion (AED 55 trillion) by 2040.

- Key barriers to addressing the finance gap are the misperception of trade finance and infrastructure investment as high-risk, and the lack of access for wider groups of investors due to regulatory burden.

- In order to narrow the gaps, there must be a significant change in the way both private and public sector actors operate and work together.

- The trade finance gap can be closed by increasing the size of the pool of finance and improving access to trade finance. Technology has a major role to play but needs to be supported by global agreement on the digitalization of trade finance.

- The infrastructure finance gap can be closed by finding solutions to enable reserves of private capital to enter the infrastructure investment pool. This requires coordination with the government and greater innovation in infrastructure planning and development overall.

Sustainability in trade

- Sustainability is moving from a ‘nice to have’ to a necessity for companies as pressure mounts from consumers, governments, and the investor’s community.

- However, business leaders remain divided on whether sustainability is an economic imperative. While the incorporation of sustainability into business models is fast approaching a tipping point – it is not quite there yet.

- The lack of comprehensive solutions, global regulatory frameworks, and standardized reporting remains a barrier to comprehensive implementation.

- In order for this to change, innovative solutions are required, which could include the use of technology and stronger policy coordination in both bilateral and multilateral agreements.

- The COVID-19 pandemic may have both positive and negative impacts on sustainability in business – though there is an increasing understanding of the benefits of sustainable business practices, the priority for governments will be on restarting national economies.

- DMCC has debuted a new index tracking the trade of environmentally sound technologies (ESTs). Tracking sustainability through trade-in ESTs is a way to showcase how countries are re-industrializing in an environmental way. Unsurprisingly, the key economies buying and disseminating green technologies globally are some of the world’s biggest economies. China is currently the biggest exporter of ESTs, followed by Germany and the US – all heavy producers of ESTs. Similarly, the US, China, and Germany are also the largest importers of ESTs.