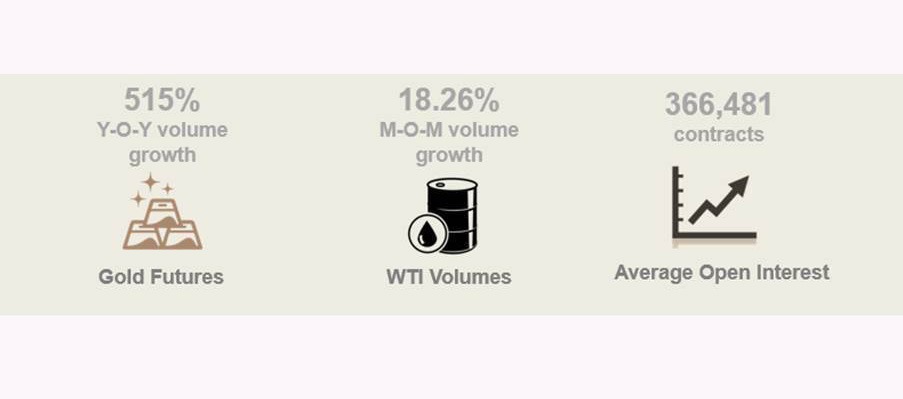

The Dubai Gold & Commodities Exchange (DGCX) has started 2020 strongly, with its flagship Gold Futures product in January recording its best month of trading since July 2008. The product recorded month-on-month (M-O-M) volume growth of 66.25%, and year-on-year (Y-O-Y) volume growth of 515%, as increasing geopolitical tensions across the globe, drove investors towards safe-haven assets. The DGCX’s West Texas Intermediary (WTI) Futures also underpinned trading last month, registering M-O-M volume growth of 18.26%.

Another indicator of the Exchange’s promising start to the year was its monthly Average Open Interest (AOI) in January, which registered 366,481 contracts, up from 314,729 contracts in December last year. AOI in 2019 overall was 324,803, its highest yearly AOI ever.

Les Male, CEO of DGCX, commented: “We are immensely proud of the growth we experienced last year, and are delighted that we have continued our trajectory into 2020 with robust trading across the board, particularly in our flagship Gold Futures product. January’s strong performance against a volatile backdrop indicates a positive outlook for the upcoming year, as we look forward to further consolidating our position as the largest and most diversified bourse in the Middle East, and providing our members and participants with a wider range of products to safely hedge their risk.”

The DGCX’s G6 currency portfolio was another driver of trading last month, registering a 419% Y-O-Y volume increase. Among the currency pairs, the Australian Dollar (AUD) was the most prominent, registering its best month of trading since June 2010.