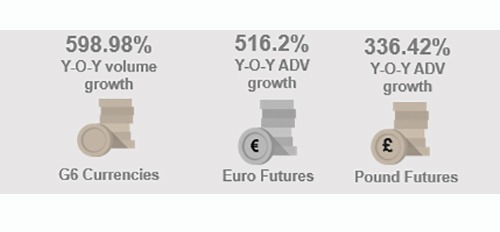

Dubai Gold and Commodities Exchange (DGCX) continues to provide investors with a wide range of derivative products that allow them to manage their risk effectively. In May, the DGCX recorded year-on-year (Y-O-Y) volume growth of 598.98%, based on the standout performance of its G6 currencies portfolio. Currently, the portfolio recorded year-to-date (Y-T-D) volume growth of 520.72% as compared to the same period last year.G6 currency pairs including Euro, British pound, and Yen Futures contracts inscribed spectacular performances registering Y-O-Y ADV growth of 516.2%, 336.42%, and 588.67% respectively.

“We are seeing continued currency volatility with markets and investors being pulled by two opposing currents; concerns over rising tensions between the US and China, and increasing optimism as lockdown measures ease across the globe. The upward trajectory of the DGCX’s G6 currency volumes reflects the strength and depth of our offerings in today’s uncertain climate and is testament to our efforts to widen investor participation and enhance liquidity” stated by Les Male, CEO, DGCX

The portfolio of currency products with FX Rolling contracts for three currency pairs has been expanded. It is anticipated that expansion would be beneficial to the institutional investors by enabling them to hedge more efficiently during this period of volatility and uncertainty.

In May, contracts totaled 880,000 on the DGCX, valued at USD 20.66 billion. Last month it recorded average Open interest (AOI) of 167,297 contracts.