Burgundy Diamond Mines Limited (ASX:BDM) provided its financial and operating results for the third quarter (Q3-2024) ended September 30, 2024, to the Australian Stock Exchange on October 29,2024.

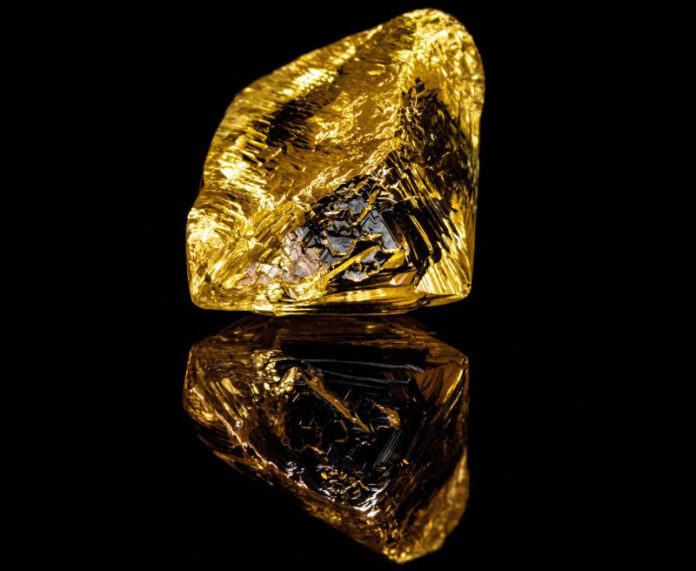

During the quarter, Burgundy focused on debt repayment of its Convertible Notes (totalling $23.6 million), mine extension activities at Misery underground mine, and completed 40% of its Sable underground prefeasibility study, upon which the decision was made to reschedule the project start date, due to positive Misery mine extension results. Additionally, operations have started the transition from the Sable mine to the Point Lake open mine pit, which is being prepared for ore production in Q1-2025. A special milestone for Ekati this quarter, was the recovery of the operation’s 100 millionth carat after twenty-six years of production, which is a significant achievement.

Third quarter operational and financial highlights:

All currency unless otherwise noted, is presented in US dollars.

Ore tonnes mined: 0.80 million tonnes, decreased by 35% from (Q3-2023: 1.24 million tonnes)

Tonnes processed: 1.12 million tonnes, up by 3% from (Q3-2023: 1.09 million tonnes)

Carats recovered: 1.24 million, decreased by 9% from (Q3-2023: 1.37 million)

Carats recovered per tonne processed: 1.10 C/t, decreased by 12% from (Q3-2023: 1.25 C/t)

Carats sold: 1.42 million over three sales events, up 80% from (Q3-2023: 0.79 million)

$83/ct. achieved for total proceeds of $118 million (A$171 million)

EBITDA: $21.8 million; (A$31.5 million)

Cash and cash equivalents of $72.4 million; up $15.5 million from Q2-2024

“We achieved another strategic objective for the Company this quarter by repaying our Convertible Note debt of ~$23 million. The decision to repay this in cash shows Burgundy’s confidence in the business,” said Kim Truter, CEO and Managing Director of Burgundy Diamond Mines.

“Over the quarter, even with debt repayment, our cash position closed at ~$72million, up ~$16 million from the June quarter. Our net debt, excluding diamond inventories, now sits at ~$23 million, so the Company is in a strong position to meet its commitments. Last month we announced our positive mine extension drilling results from Misery mine. Given the likely extension of Misery, no major capital expenditure is anticipated in 2025. Burgundy is looking forward to our next quarter and building on progress covering mine extension work, sale and marketing strategies, and cost reduction initiatives.”